The Facts and Figures of Aircraft Depreciation

You’ve likely heard the adage that once you drive your brand new vehicle off the lot, it instantly depreciates by roughly 10%. In some cases, the same thing can be said about aircraft depreciation. However, the depreciation process for your business accounting purposes for an aircraft involves several more facets than a regular road vehicle.

In an effort to remain transparent and educate our clients, we put together a quick reference guide outlining everything there is to know about aircraft depreciation.

Aircraft Depreciation Terms You Should Know

Before we jump into the basics of jet depreciation, there are a few terms to get comfortable with. They include:

- Cost – the initial purchase price of the aircraft.

- Obsolescence – a factor that affects the depreciation period.

- Recovery period – the lifespan of the aircraft.

- Salvage value – the money the owner could potentially receive if the aircraft is scrapped, sold, or traded in.

What Is Aircraft Depreciation?

In its most basic form, depreciation is defined as a reduction in the value of an asset over time. When a business spends capital on a long-term asset, like an aircraft, it’s understood that the value of the airplane depreciates over time.

Here’s a quick breakdown of some common airplane depreciation life estimates:

- Commercial passenger aircraft: 15-25 years

- Commercial cargo aircraft: 12-20 years

- Private jets: 5-10 years

Understanding aircraft depreciation life is crucial for:

- Businesses: Accurate financial planning and asset management.

- Individuals: Making informed decisions about aircraft purchase and ownership costs.

- Investors: Analyzing the financial health of airlines and companies that own aircraft.

Remember, these are just general estimates.

Aircraft that are owned and operated by a business are often depreciable for income tax purposes. These claims can be made during the recovery period. However, there are several different ways to claim your airplane depreciation, and each method has its own list of pros and cons.

The Two Different Recovery Periods

The two defined recovery periods are known as MARCRS and GAAP.

- MARCRS (Modified Accelerated Cost Recovery System) is the method specifically used for the IRS. From a couple of years to decades, it specifies the respective periods for all assets.

- GAAP (Generally Accepted Accounting Principles) is the period of recovery used for financial reporting by the business that owns and operates the aircraft. GAAP sets the rules for this kind of reporting.

The Different Depreciation Methods Explained

Even though there are a wide variety of methods, they all have a few steps in common. They include:

- Finding the annual depreciation.

- Booking the annual depreciation amount.

- Stopping the depreciation when the asset becomes worthless.

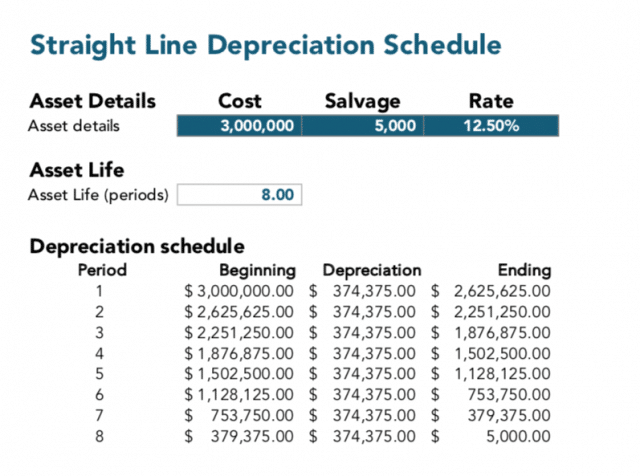

1. Straight-line Method

This is the most common method for recording depreciation. It’s also the simplest. First, you find the period of recovery then book the year’s depreciation (book value – salvage value/recovery period).

2. Double-declining Balance Method

This method produces high depreciation values at the beginning then slowly tapers off as the years go by.

To find the annual depreciation, use the double-declining balance depreciation rate (which is double that of the straight-line method). Then record the annual depreciation (starting net book value x depreciation rate). Repeat annually until the book value and the salvage amount are the same.

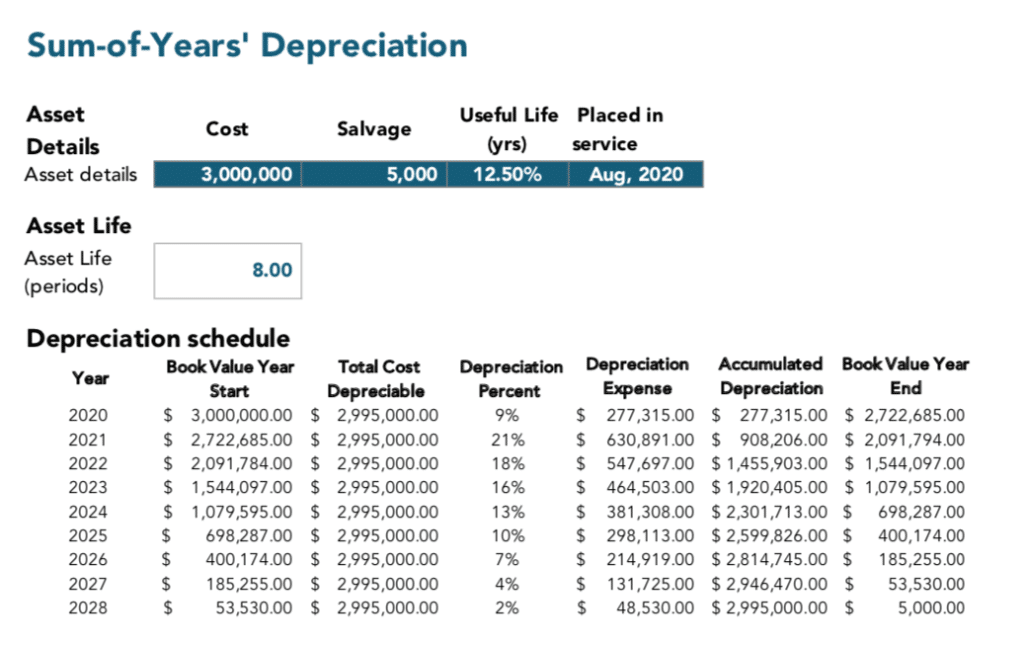

3. Sum-of-years’ Digit’s Method

This method is typically less aggressive than the previously mentioned method, but it’s important to note that it disregards net book value entirely.

First, you find the sum of the digits using (n2 +n)/2, where the recovery period is. Then you calculate the depreciation. It’s equal to the initial cost minus salvage value.

Once you have those figures, you find the annual factor by dividing the digits’ sum by the years remaining.

Finally, you can find the annual depreciation by multiplying the annual factor by the depreciable amount.

Special Tax Provisions to Consider

In addition to claiming depreciation, aircraft owned by a business can also benefit from Section 179 Expensing and Bonus Depreciation.

Section 179 Expensing allows businesses to deduct capital assets as an expense in the current year as opposed to stretching it out over several years. This can be done through IRS Form 4562.

Bonus Depreciation can be used if the aircraft is used for business purposes at least 50 percent of the time. It has no new income requirement or value cap. It’s an incredibly popular option for businesses as it allows the company to take 100 percent of the airplane’s depreciation in the first year of ownership as opposed to amortizing the airplane depreciation over five years.

Owning a private jet for business also has distinct tax benefits with Section 179. These programs enable faster private jet tax deductions, letting you write off expenses like aircraft purchase costs or ongoing maintenance more quickly. Section 179 allows current-year expense deductions for eligible assets, while Bonus Depreciation allows you to deduct the entire aircraft cost in the first year of ownership. This means your private jet depreciation schedule gets a major boost, giving you more flexibility and savings.

Aircraft Bonus Depreciation on New & Used assets

One of the biggest benefits of bonus depreciation for aircraft is that it delivers a long-term stimulus to the aviation industry. This is especially important because the aviation industry is responsible for high-skill and high-paying jobs for approximately 1.1 million Americans and generates roughly $220 billion in economic activity.

Initially, bonus depreciation only applied to new aircraft. It was put in place to help manufacturers make more sales and strengthen the market. In 2017, Congress extended the rules of bonus depreciation to used aircraft as well.

This change has impacted the business aviation industry in a big way. After years of plummeting used aircraft values, the preowned aircraft industry has never been stronger.

However, the IRS has started to phase out bonus depreciation. The maximum deduction amount drops to 80 percent in 2023, 60% in 2024, 40% in 2025, and 20% in 2026. The deduction will no longer be available in 2027.

You asked, we answered

We often get asked about airplane depreciation, especially by clients looking into aircraft ownership. Here are the answers to a few frequently asked questions:

Is an airplane a fixed asset?

Yes, an airplane is a fixed asset as it is a purchase for long-term business use and can’t be converted into cash quickly.

Can I take bonus depreciation on my airplane?

Yes, you can take bonus depreciation on your airplane if the aircraft is new to you and is used for business purposes at least 50 percent of the time.

Do airplanes hold their value?

When used for your business, airplanes are depreciated every year down to the aircraft’s residual value.

Should I depreciate my aircraft?

Yes, if you can. If your aircraft is owned and operated by the business, you qualify.

What if I sell the aircraft I depreciated?

The depreciated claim reduces the base cost of the aircraft. This means the profit you received from the sale is treated as ordinary income and not capital gain.

Why is tax depreciation accelerated on aircraft?

This allows you to recover your costs faster. If you depreciate your assets as quickly as possible, you can use the tax savings sooner.

What expenses can you deduct for a business aircraft?

You can deduct all expenses related to the operation and maintenance of an aircraft, including:

- Repairs

- Regular maintenance costs

- Licenses

- Permits

- Crew-related costs

- Fuel costs

- Depreciation

Stratos Jet Charters, Inc. has been in the business of arranging private aviation for more than a decade. We pride ourselves on our transparency, safety standards, and service excellence. For more information, quotes, and more, call us today – (888) 593-9066

Are you ready to book your Dallas and Boston charter flight yet?

Our friendly, expert air charter agents are here to answer questions or start your quote today. Don`t wait, call now and we'll get you on your way to your destination!

Call 888-593-9066